September 23, 2024 | Peter Long

Selling to Schools and Districts: Part 2

The How, When, What and Why of K-12 Purchasing Cycles

In Part 1 of this blog series, we explored the timing of the educational purchasing process (the "When") and provided a brief overview of the district buying phases, including gathering information, requesting quotes, budgeting, and purchasing (the "How"). In an upcoming edition of Monday Marketing Moments, we’ll dive deeper into the “How,” as it involves multiple steps such as teacher evaluations, RFP guidelines, district administrator approvals, and budget requirements. Today, in Part 2, we focus on the “What” districts and schools are purchasing, while Part 3 will cover “Why” they choose to buy from you—or your competitors.

Schools purchase a wide range of physical products such as supplies, furniture, food, security equipment, and cleaning materials. For generic products, strict rules often require price comparisons, multiple quotes, and sourcing from the best value providers. While these products are essential to school operations, this blog focuses on the unique process of purchasing educational solutions—tools and resources used by students and teachers for learning or classroom management. When discussing “What” schools and districts buy, we’re referring to the ways companies can learn about their needs, gather opinions, and collect feedback on innovative educational solutions.

|

|

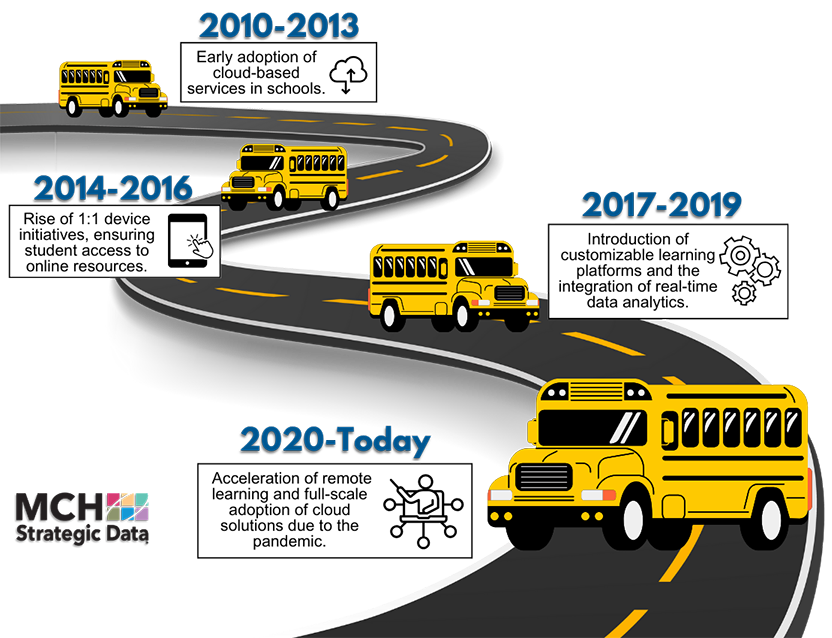

| The Evolution of K12 Education Technology |

In today’s dynamic market for educational products and services, educators have endless options at their disposal. New educational trends emerge constantly, challenging older, more conventional methods. With modern technology—high-speed internet, cloud computing, and scalable software—educational solutions are now globally available at a fraction of the cost of older, installed software models. These solutions offer powerful capabilities, including customized learning, progress tracking, and integration with other platforms. However, the key challenge for educators today is understanding how to effectively implement these tools in an increasingly complex and fast-paced classroom environment. As the range of targeted educational solutions continues to expand, it’s more critical than ever to understand what schools and districts truly need. So, how can modern curriculum providers determine “What” educators and schools want?

Answering the question of "What do schools and districts need?" has always been a challenge, with traditional methods often involving lengthy testing, costly consultants, and structured research projects. These processes required extensive validation cycles, efficacy testing, and long-term measurements. However, as the pace of change accelerates, the methods for selling to schools and understanding their needs have evolved. Let me share a real-world example that highlights this shift.

Recently, I had lunch with a friend who introduced me to John, an entrepreneur developing a phone-based app for middle school students who struggle with staying on task. John, a trained Child Behavioral Psychologist, created the app based on his extensive experience working with children who have difficulty completing tasks. The app is designed to help students manage schoolwork, homework, and chores through a gamified system of rewards, reducing the need for repetitive adult supervision. John was eager to explore how to market this app—whether to parents, teachers, or district administrators—and wanted feedback on features, pricing, and positioning from these various audiences.

In the past, research of this kind could have taken a year or more and cost tens of thousands—if not hundreds of thousands—of dollars. Traditional methods, like district pilot projects and research round tables, required extensive time and resources. However, modern technology has revolutionized not only how educational solutions are created and distributed, but also how companies gather needs, collect market data, and obtain feedback on new ideas and features. This shift is a game-changer for companies selling to schools, allowing for faster validation and more efficient market testing.

The rise of social media and targeted group discussion platforms has made gathering product development feedback easier than ever. Companies selling to schools now leverage a variety of channels to collect insights, including:

- Webinars: Not only for promoting products, but also for gathering feedback and gauging interest.

- Professional development sites: Platforms like edWeb.net offer hundreds of specialized education topic groups, where conversations can take place at no cost.

- YouTube channels: Affordable discussions around product education happen here, and content creators often engage with their audience, providing feedback and insights.

- Market influencers: Influencers review products and solutions, often for free, as part of their content creation.

- Educational topic groups: Spaces like Facebook, Reddit, and list-serves enable valuable feedback and discussions.

- Educational trade shows:Though traditional, trade shows still provide effective connections and opportunities for feedback.

Ultimately, I was able to guide John toward specialized industry discussion groups focused on social and emotional learning. These groups provided valuable feedback on his app, including insights into how educators viewed its potential fit in the classroom. Most of the information John gathered was free, and the quantity and quality of feedback were remarkable compared to the traditional, time-intensive methods of just a decade ago. Quick feedback, combined with flexible product design, helps companies avoid costly product missteps. This more agile approach results in a responsive educational marketplace, where curriculum products and services are better designed to meet the needs of schools and districts.

The ability to quickly iterate and scale improvements allows for faster, more impactful changes. The lower entry pricing of SaaS models enables schools to test and evaluate tools efficiently, allowing for broad implementation if successful or swift discontinuation if not. This flexibility has transformed the buying process, making it easier to launch new solutions or pivot as needed. When seeking ideas or feedback, modern technology platforms provide excellent resources for gathering input. While your company may still need formal statistical validation for certain products, these new channels reduce costly errors and accelerate time to market for promising solutions.

A solid database is crucial for driving analysis in these processes. It allows your company to identify the types of educators, schools, and economic areas you are engaging with. Whether through messaging educators, conducting surveys, or performing other outreach activities, the success of your efforts is driven by the quality of the data you have. While feedback is critical, understanding the demographics and characteristics of your audience—such as educator types, geographic coverage, and economic factors—is equally important to ensure you're reaching the right personas and collecting statistically valid responses.

Stay tuned for part three of our three-part blog series coming next week!

More Insight from MCH

- Check out Part 1 in the series here!

- Download our School Calendar Reference Guide for the 2024/2025 school year and get key insights from over 80,000 school calendars across the U.S.

- Download our Email Marketing to Educators 2024 whitepaper.

About MCH

For nearly a century, MCH has empowered educational marketers with the data, tools, and solutions needed to thrive. Our cutting-edge technology continuously updates and verifies millions of educator records, ensuring you have the most accurate information for your campaigns.

Use our free ListBuilder tool to explore our education data, or Contact Us to strategize as a team.

Need More Time?

Due to inactivity, you will be logged out within 5 minutes.

To stay logged in, please select Stay Logged In.

Logout

Logout